You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CAR INSURANCE THOUGHTS

- Thread starter JAGBOB

- Start date

A

Anonymous

Guest

They tend to be cheaper options with more exclusions.

For example they don't cover panoramic glass.

Repairs can be done using none genuine manufacturer parts.

I always check that the insurer covers everything and includes Jaguar approved workshops on its list of approved repairers.

For example they don't cover panoramic glass.

Repairs can be done using none genuine manufacturer parts.

I always check that the insurer covers everything and includes Jaguar approved workshops on its list of approved repairers.

NaCl

New member

simpleR said:For example they don't cover panoramic glass.

Repairs can be done using none genuine manufacturer parts.

Wow, great point. I've never considered that when purchasing insurance. Welp, time to spend tonight reading through the T&C's of my current one. Fingers crossed my roof is covered lol...

A

Anonymous

Guest

I've been with LV for a long time.

They tend to be quite competitive and are one of the cheapest of the big known companies for me at least.

And they cover everything including pano glass and have aluminium Jaguar approved workshops as options. I called them earlier and got straight through to a UK person.

They tend to be quite competitive and are one of the cheapest of the big known companies for me at least.

And they cover everything including pano glass and have aluminium Jaguar approved workshops as options. I called them earlier and got straight through to a UK person.

simpleR said:I've been with LV for a long time.

They tend to be quite competitive and are one of the cheapest of the big known companies for me at least.

And they cover everything including pano glass and have aluminium Jaguar approved workshops as options. I called them earlier and got straight through to a UK person.

+1

Have multi car policy with LV. Been with them for 3 yrs now.

TopCat

New member

simpleR said:I called them earlier and got straight through to a UK person.

A UK call centre should be compulsory for every insurance company operating in the U.K.

I’m also with LV for the F, the panoramic roof cover was part of the consideration.

cj10jeeper

New member

Another vote for LV as have a multicar policy with them. The F Type comes out at <£250 within it, so competitive (for me) Vs standalone.

Sadly I have concluded that 3 years with any provider is my maximum before the shop around game starts again. Any longer and premiums ratchet up and you run out of negotiation to match or reduce premiums to be retained.

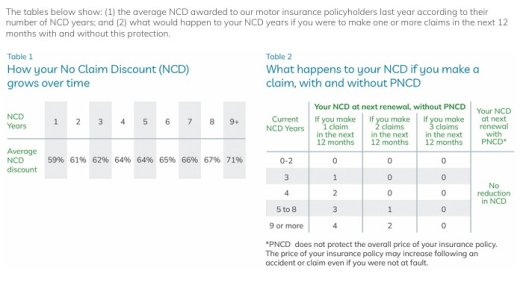

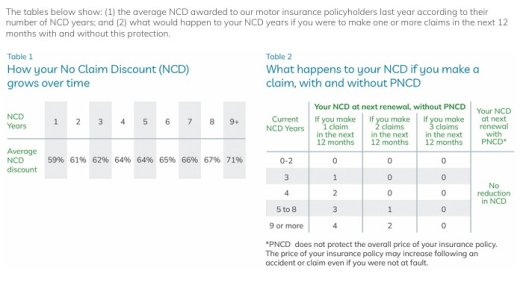

You may find this interesting from LV how little NCB increases over time or decreases following an accident. Paying premiums for NCB can also cost way more than the future discounts on protection. Worth running the numbers as it's shocking how much they charge for NCB protection Vs how little benefit you get,

Sadly I have concluded that 3 years with any provider is my maximum before the shop around game starts again. Any longer and premiums ratchet up and you run out of negotiation to match or reduce premiums to be retained.

You may find this interesting from LV how little NCB increases over time or decreases following an accident. Paying premiums for NCB can also cost way more than the future discounts on protection. Worth running the numbers as it's shocking how much they charge for NCB protection Vs how little benefit you get,

scm

New member

cj10jeeper said:You may find this interesting from LV how little NCB increases over time or decreases following an accident. Paying premiums for NCB can also cost way more than the future discounts on protection. Worth running the numbers as it's shocking how much they charge for NCB protection Vs how little benefit you get,

And having NCD protection doesn't make you immune from a massive premium increase, which probably makes the NCD protection moot.

cj10jeeper

New member

Fully agree and the LV disclaimer makes it clear the Protected NCB doesn't impact future premiums which may increase even in the event of a 'not at fault accident'scm said:cj10jeeper said:You may find this interesting from LV how little NCB increases over time or decreases following an accident. Paying premiums for NCB can also cost way more than the future discounts on protection. Worth running the numbers as it's shocking how much they charge for NCB protection Vs how little benefit you get,

And having NCD protection doesn't make you immune from a massive premium increase, which probably makes the NCD protection moot.

JAGBOB

New member

My F type V8 AWD car insurance last year with NFU was £480 and this year is £1100. Went on various comparison sites prices vary from Esure £340, Sheila's wheel £360. Tried Aviva on there website and quoted £1559. I used Quidco and got Aviva for £550 plus £45 back via Quidco, and the same policy details as the Aviva website quote. My car and personal insurance details are the same as last years so nothing has changed. I would recommend checking the small print and reviews of what's covered on the cheaper car insurance quotes as maybe okay for a small cheap run around car but could be a problem on the F type claims.

ianp

New member

Pleased to say some good news in these dark news days. In-spite of my earlier comment making it look as though my insurance renewed in February, it was in fact last May. I am very please that my annual insurance has reduced by over £120. It has been higher than I would have liked as I had to make a non-fault claim for a damaged rear bumper. Whilst my NCB was protected the premiums still went up!

What is it with some insurance operators after 2 years with Tesco, starting with 0 NCB 1st yr £800, 2nd yr £687 and now £1,523  . No claims or convictions, so re Tesco I’m not sure if it’s my age or the car or possibly both. Anyway gone with Hastings £426 including an additional £20 for 24 hr direct contact cover ( a contact person not just on line) and as bought through confused.com received a £20 credit voucher. So Tesco you can stick your “Every Little Helps” where the sun doesn’t shine.

. No claims or convictions, so re Tesco I’m not sure if it’s my age or the car or possibly both. Anyway gone with Hastings £426 including an additional £20 for 24 hr direct contact cover ( a contact person not just on line) and as bought through confused.com received a £20 credit voucher. So Tesco you can stick your “Every Little Helps” where the sun doesn’t shine.

Lord Farquad

New member

The car insurance industry and those that feed off it (repairs, hire cars, injury claims) is an absolute disgrace and needs radical overhaul.

Luckily our top politicians are all over it…..

Luckily our top politicians are all over it…..

Lord Farquad said:The car insurance industry and those that feed off it (repairs, hire cars, injury claims) is an absolute disgrace and needs radical overhaul.

Luckily our top politicians are all over it…..

cj10jeeper

New member

It’s mainly ‘inertia’. There’s reluctance of consumers to change products such as insurance, bank, credit cards, etc.

It allows for easy price increases and a lack of competition.

Of course they also adjust prices in sectors based on losses and their desire to remain in sector or not.

One of the reasons I rarely end up with the same company for any form of insurance more than 2 years.

It allows for easy price increases and a lack of competition.

Of course they also adjust prices in sectors based on losses and their desire to remain in sector or not.

One of the reasons I rarely end up with the same company for any form of insurance more than 2 years.

Similar threads

- Replies

- 7

- Views

- 5K